after tax income calculator iowa

After Tax Income Calculator Iowa. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457.

Tax Calculator Estimate Your Income Tax For 2022 Free

The Iowa Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

. After Tax Income Calculator Iowa. That means that your net pay will be 43543 per year or 3629 per month. Iowa Inheritance Tax Rates.

The following steps allow you to calculate your salary after tax in Iowa after deducting Medicare Social Security Federal Income Tax and Iowa State Income tax. 2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

However the rates will be gradually reduced to meet the revenue. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Tax Calculators Tools.

Your gross income and your net income are two very different figures. The amount the parent will pay in land transfer tax would be 64752 - 0 323750. You can alter the salary example to illustrate a different filing status.

After Tax Income Calculator Iowa. After a few seconds you will be provided with a full breakdown of. Gross income is your actual earnings before any deductions for taxes.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate. Tax March 2 2022 arnold. This places US on the 4th place.

Financial Facts About the US. Net to Gross Paycheck Calculator Overview. Corporations in Iowa pay four different rates of income tax.

Your average tax rate is 1069 and your marginal tax rate is 22. You can alter the salary example to illustrate a different filing status. You can use this tax calculator.

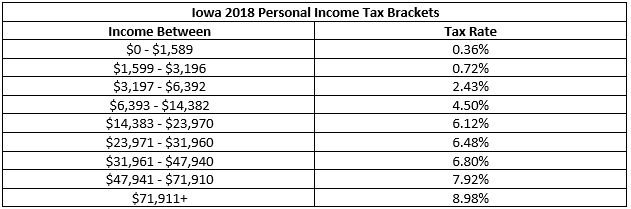

Each salary calculation provides a full salary package illustration and is based on the Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income Tax Rates and Thresholds. Your average tax rate is 217 and your marginal tax rate is 360. Tax March 2 2022 arnold.

United States Italy France Spain United Kingdom Poland Czech Republic Hungary. If you would like to update your Iowa withholding. Calculate your net income after taxes in Iowa.

Were proud to provide one of the most comprehensive free online tax calculators to our users. After Tax Income Calculator Iowa. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The top marginal rate of 98 will remain in place until 2022. This is only a high level federal tax income.

Fields notated with are required. Iowa Income Tax Calculator 2021 If you make 62000 a year living in the region of Iowa USA you will be taxed 11734. The Federal or IRS Taxes Are Listed.

Llc Tax Calculator Definitive Small Business Tax Estimator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

An Introduction To Iowa Property Tax Story County Ia Official Website

Iowa Income Tax Calculator 2022 2023

2021 Capital Gains Tax Rates By State

Iowa Food Stamps Eligibility Guide Food Stamps Ebt

United States Us Salary After Tax Calculator

![]()

Iowa Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Iowa Salary Paycheck Calculator Gusto

Tax Withholding For Pensions And Social Security Sensible Money

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

1099 Tax Calculator How Much Will I Owe

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Sf 2206 Senate S Comprehensive Tax Reform Proposal Iowa League

Tax Facts For People With Disabilities Iowa Compass

Changes In Sales Use And Excise Taxes In Iowa Uhy

How Is Tax Liability Calculated Common Tax Questions Answered